2bets.ru Prices

Prices

How Much Extra To Pay Off Loan Early

Making an extra payment each month or putting some, or all, of a cash windfall, toward your loans, could help you shave a few months off your repayment period. First, divide your monthly principal and interest payment by The subsequent amount will be the extra payment you need to add each month. For example, your. Use our loan payoff calculator to see when your mortgage or other loan will be paid off in full. / Loan Calculator. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest. However, you don't have to pay that much. Paying extra each month. When making your payments, add extra money to pay down your balance a little bit at a time. This not only lowers your overall balance. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Loan InformationPart 1. Loan Information. Original. This early payoff calculator, lump sum calculator, and extra payment calculator will determine your savings and how much faster you will pay off your loan. Make extra payments each month, pay off your loan faster, and save thousands in overall interest. You will be surprised how fast the savings can add up. You decide to make an additional $ payment toward principal every month to pay off your home faster. By adding $ to your monthly payment, you'll save just. Making an extra payment each month or putting some, or all, of a cash windfall, toward your loans, could help you shave a few months off your repayment period. First, divide your monthly principal and interest payment by The subsequent amount will be the extra payment you need to add each month. For example, your. Use our loan payoff calculator to see when your mortgage or other loan will be paid off in full. / Loan Calculator. Doing so can shave four to eight years off the life of your loan, as well as tens of thousands of dollars in interest. However, you don't have to pay that much. Paying extra each month. When making your payments, add extra money to pay down your balance a little bit at a time. This not only lowers your overall balance. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Loan InformationPart 1. Loan Information. Original. This early payoff calculator, lump sum calculator, and extra payment calculator will determine your savings and how much faster you will pay off your loan. Make extra payments each month, pay off your loan faster, and save thousands in overall interest. You will be surprised how fast the savings can add up. You decide to make an additional $ payment toward principal every month to pay off your home faster. By adding $ to your monthly payment, you'll save just.

extra payment or multiple periodic extra payments either separately or combined. Before deciding to pay off a debt early, borrowers should find out if the loan. The following calculator makes it easy for homeowners to see how quickly they will pay off their house by making additional monthly payments on their loan. Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are required. This financial calculator helps you find out. View the report to see a complete amortization payment schedule, and how much you can save on your auto loan! How to pay off a mortgage early · Use the 1/12 rule. Divide your monthly principal payment by 12, then add that amount to each monthly payment. · Use a savings. Paying off a personal loan early may save you money in interest, but it's important to consider all factors before you make that lump-sum payment. · Make sure. If you're considering paying off your loan early, use this calculator to see how it will affect the total, the interest, and the timetable. By making consistent regular payments toward debt service you will eventually pay off your loan. Use this calculator to determine how much longer you will need. Using the Student Loan Payoff Calculator · 1. Multiple each loan amount by its interest rate to get the “per-loan weight factor.” · 2. Add all per-loan weight. Use this free calculator to help determine how much money you might be able to save by increasing your monthly loan payment. If you're considering paying off your loan early, use this calculator to see how it will affect the total, the interest, and the timetable. The Auto Loan Early Payoff Calculator shows you a complete amortization schedule & how much you can save on your auto loan by increasing your payment. Since lenders make their money on the amount of interest you pay, it's possible there will be a repayment fee if you decide to pay it off early. What you'll. An additional $50, or even $25 extra principal each month may make a surprising difference. You can save a lot of interest if you pay down the loan 2bets.ru 1. Make bi-weekly payments · 2. Round up your monthly payments · 3. Make one extra payment each year · 4. Refinance · 5. Boost your income and put all extra money. An extra monthly payment of $ will pay off your loan by 10/04/ and save you $40, in interest. Show details. Is it worth paying extra on your mortgage? Making an extra payment on your mortgage can help you pay off your mortgage early. It also helps reduce the. Making an extra mortgage payment each year could reduce the term of your loan significantly. The most budget-friendly way to do this is to pay 1/12 extra each. your loan and pay off your loan faster with small additional monthly payments toward your debt. Use this calculator to see how extra payments will affect your.

What Is The Best Luxury Car For The Money

Best Luxury Cars & SUVs ; Audi Q3. $37, - $39, ; Buick Encore GX. $25, - $33, ; Buick Envision. $35, - $47, ; Cadillac XT4. I mainly bought it because it was a bigger car to better safeguard my family. Best try to spend your money before the market takes it all away!:) It's. The Lexus ES, Mercedes-Benz E-Class, and Audi A7 are the highest-rated models on 2bets.ru's list of best luxury midsize cars. Which of the best. Here are some luxury cars you can buy for under $30, · Jaguar XF: The XF is a stylish and comfortable sports sedan with a L turbocharged I4 engine. One of the most affordable high-performance sports cars from Japan is the Subaru BRZ / Toyota 86 twins. These cars offer excellent handling, a. Reid All About It: Used Luxury Sedans are Great Buys · to Mercedes-Benz S Class · to BMW 7 Series · to Lexus LS · to What Luxury Car Is the Best Investment? With impressive resale value ratings, the Acura RDX is a smart luxury investment. It comes well-equipped with. What is the most popular luxury car brand in the US? · 1. Tesla - Electrifying luxury · 2. BMW - The ultimate driving machine · 3. Mercedes-Benz - The best or. Best MPG Luxury Cars ; #1 - Tesla Model X Plaid AWD ; #2 - Mercedes-Benz EQS EQS + S ; #3 - BMW i4 M50 Gran Coupe. Best Luxury Cars & SUVs ; Audi Q3. $37, - $39, ; Buick Encore GX. $25, - $33, ; Buick Envision. $35, - $47, ; Cadillac XT4. I mainly bought it because it was a bigger car to better safeguard my family. Best try to spend your money before the market takes it all away!:) It's. The Lexus ES, Mercedes-Benz E-Class, and Audi A7 are the highest-rated models on 2bets.ru's list of best luxury midsize cars. Which of the best. Here are some luxury cars you can buy for under $30, · Jaguar XF: The XF is a stylish and comfortable sports sedan with a L turbocharged I4 engine. One of the most affordable high-performance sports cars from Japan is the Subaru BRZ / Toyota 86 twins. These cars offer excellent handling, a. Reid All About It: Used Luxury Sedans are Great Buys · to Mercedes-Benz S Class · to BMW 7 Series · to Lexus LS · to What Luxury Car Is the Best Investment? With impressive resale value ratings, the Acura RDX is a smart luxury investment. It comes well-equipped with. What is the most popular luxury car brand in the US? · 1. Tesla - Electrifying luxury · 2. BMW - The ultimate driving machine · 3. Mercedes-Benz - The best or. Best MPG Luxury Cars ; #1 - Tesla Model X Plaid AWD ; #2 - Mercedes-Benz EQS EQS + S ; #3 - BMW i4 M50 Gran Coupe.

Luxury saloon / full-size luxury sedan · Mercedes-Benz S-Class (–present) · BMW 7 Series (–present) · Audi A8 (–present). Best luxury cars of · 1. Audi A8 · 2. Mercedes S-Class · 3. Bentley Continental GT · 4. Porsche Panamera · 5. Rolls-Royce Spectre. Many vehicles and brands can be considered luxury vehicles for insurance purposes. There are high-end brands such as Ferrari, Lamborghini, Bentley, Aston Martin. Select Your Currency. USD ($) CAD ($) EUR (€). USA (English). Select a Car Finder can narrow down your choices. Find Your Best Match. Compare Luxury. Top Gear's top luxury cars · Jaguar XJ · Porsche Panamera · Bentley Bentayga · Rolls-Royce Wraith · BMW 7 Series · Audi A8 · Bentley Continental GT · Rolls-Royce. The Genesis GV70 is our favorite small luxury SUV for a number of reasons. You'll save a few thousand compared to the Mercedes-Benz GLC or BMW X3, but that's. These luxury vehicles boast the best in performance, EPA-estimated mileage ratings, * and safety with endless options for a personalized luxury experience. Best Used Luxury Car Brands Of all the best used luxury cars, several brands continue to excel. The first is BMW. Driving performance is heightened in the. In my opinion, any car that costs more than 50% of the average new car price is considered a luxury automobile. Best try to spend your money before the market. For many drivers and buyers around the world, the Mercedes-Benz S-Class is the very quintessence of the luxury sedan. And with good reason. Not only is it the. One of the most affordable high-performance sports cars from Japan is the Subaru BRZ / Toyota 86 twins. These cars offer excellent handling, a. With a budget of $60,, you're right in the middle of the luxury car market. The options from which you can choose are wide-ranging. Of course, small and. Luxury Vehicles with the Best Resale Value · Acura NSX · Chevrolet Corvette Z06 · BMW M2 CS · BMW M5 CS · Lexus LX · Porsche. Best luxury cars of · 1. Audi A8 · 2. Mercedes S-Class · 3. Bentley Continental GT · 4. Porsche Panamera · 5. Rolls-Royce Spectre. Luxury saloon / full-size luxury sedan · Mercedes-Benz S-Class (–present) · BMW 7 Series (–present) · Audi A8 (–present). Best Used Luxury Car Brands Of all the best used luxury cars, several brands continue to excel. The first is BMW. Driving performance is heightened in the. Best affordable electric car Yes, the Nissan Leaf is cheaper but it's so woefully outdated that it's difficult to recommend to all but the most miserly. Best Luxury Sedans ; 2bets.ruy Flying Spur. ; 2bets.ru B3. ; 2bets.ru-Royce Ghost. ; 2bets.ru A6. ; 2bets.ru LS. Essentially, you get more value for your money when you lease a new luxury car. Why do people buy luxury cars? People buy luxury cars because they're fun to. The Audi A5 is a great car and even better investment – it only loses 42% of its value after 5 years, that's less than % per year! With careful use you could.

Which Best Savings Bonds

Series EE savings bonds are a low-risk way to save money. They earn interest regularly for 30 years (or until you cash them if you do that before 30 years). A one-year fixed rate bond is a kind of savings account that asks you to lock your money away for 12 months in return for a fixed rate of interest. Both Treasury-Inflation Protection Securities (TIPS) and Series I Savings Bonds adjust for inflation. Therefore, people may wonder which they should buy. A savings account is simply a place for you to put your money and earn some interest. Savings interest will be paid to you tax-free and most savers won't pay. However, there's good news: the user-friendly Savings Bond Calculator offers more options than simply pricing bonds. Historically, Treasury has offered three. Fixed rate bonds are a type of savings account that offer a guaranteed rate of interest, provided you lock your money away for a set length of. We currently sell 2 types of savings bond: Series EE and Series I. You can buy them for yourself, your child, or as a gift for someone else. Checking account. While most checking accounts don't earn interest, some do. · Low-risk investments. These include Treasury and other government bonds. Yields on. When considering investing in U.S. savings bonds, investors often compare Series I Bonds and Series EE Bonds. While both bond types are backed by the full faith. Series EE savings bonds are a low-risk way to save money. They earn interest regularly for 30 years (or until you cash them if you do that before 30 years). A one-year fixed rate bond is a kind of savings account that asks you to lock your money away for 12 months in return for a fixed rate of interest. Both Treasury-Inflation Protection Securities (TIPS) and Series I Savings Bonds adjust for inflation. Therefore, people may wonder which they should buy. A savings account is simply a place for you to put your money and earn some interest. Savings interest will be paid to you tax-free and most savers won't pay. However, there's good news: the user-friendly Savings Bond Calculator offers more options than simply pricing bonds. Historically, Treasury has offered three. Fixed rate bonds are a type of savings account that offer a guaranteed rate of interest, provided you lock your money away for a set length of. We currently sell 2 types of savings bond: Series EE and Series I. You can buy them for yourself, your child, or as a gift for someone else. Checking account. While most checking accounts don't earn interest, some do. · Low-risk investments. These include Treasury and other government bonds. Yields on. When considering investing in U.S. savings bonds, investors often compare Series I Bonds and Series EE Bonds. While both bond types are backed by the full faith.

Series I bonds have caught investors' attention lately, primarily because they help prevent money from losing value to inflation. Unlike series EE bonds, which. Savings bonds are debt securities issued You can use the Savings Bond Calculator and compare the different types of securities issued by the Treasury. Series I U.S. Savings Bonds are sold under this program. They are a low-risk, liquid savings product that earn interest and provide protection from inflation. You can get your cash for an EE or I savings bond any time after you have owned it for 1 year. However, the longer you hold the bond, the more it earns for you. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. Compare top fixed-rate bonds and fixed-rate ISAs and read more on whether these accounts will provide you the best savings interest for your hard-earned. Fixed rate bonds tend to offer some of the highest savings rates on the market if you are happy to lock your cash away. We've compiled the best fixed-rate bond deals currently on the market so you can see which provider might best suit your needs. In fact, millions of Americans take advantage of savings bonds' competitive rates. Whether you choose Treasury's I Bond or EE Bond, your money grows and — best. 10% and Series I savings bonds will earn a composite rate of %, a portion of which is indexed to inflation every six months. The EE bond fixed rate applies. Fixed rate bonds can be a great option for a guaranteed higher return on your savings if you're prepared to lock your money away for a period. A fixed-rate bond is a type of savings account that offers a set amount of interest on your money over a set length of time – known as the 'term'. By agreeing. Key takeaways · Savings bonds are a government-backed, reliable investment that earn interest, reaching full maturity after 30 years. · The different types of. Laurel Road: Best savings account for savings plus loans. Laurel Road is Best savings accounts of April BYCasey Bond and Trina Paul. October Savings bonds earn interest until they reach "maturity," which is generally years, depending on the type purchased. If a bond is held past its maturity. Our fixed rate bonds give you a set interest rate that won't change for the duration of your term, so you know exactly what you're getting back on your. U.S. Savings Bonds The familiar EE-bonds are guaranteed by the government and are virtually risk-free. They are available for as little as $25, often through. Bonds remain a safe, easy way to save and earn money over time. The Treasury guarantees to not only pay you back – but to double your initial investment over Fixed rate savings bonds are savings accounts that often pay a higher interest rate than instant access savings accounts. Find out more in our guide.

Micro Touch Trim Reviews

How does the Micro Touch Titanium Trim work?The official review claims that the Micro Touch Titanium Trim features a completely new design where the blades. It was advertised to be superior to using the shave cream method. My son only uses it for trimming his beard. It doesn't charge for very long. The head pivots. Micro Touch Reviews Analysis ; Micro Touch Triple-Blade Razor with 6 Refill Cartridges · 4, Ratings ; Micro Touch MAX Hair Trimmer, Green · 1, Micro Touch Solo Titanium is the all in one shaving accessory you will ever need. Trim; to a perfect stubble. Edge; great for beards, sideburns. What a waste of money. Dull blade and it was ridiculous. If you read reviews, do not waste your money, unless you have little to no hair to cut. Yes, my hair is. Micro Touch Max Titanium is the all in one personal trimmer that allows you to trim hair anywhere with micro precision. Ratings and Reviews. We'd love to hear. Unlike other reviewers, I actually bought, received, and used this product before posting a review. It works very well and the assortment of guards is excellent. It gets close as a blade, yet is safe to the touch. MicroTouch Max is the ideal solution for removing unwanted ear and nosehair, and makes trimming mustaches. Trims hair anywhere with micro-precision. Made from German Stainless Steel. Professional Grade personal hair trimmer. Trims the Reviews. Community Q & A. How does the Micro Touch Titanium Trim work?The official review claims that the Micro Touch Titanium Trim features a completely new design where the blades. It was advertised to be superior to using the shave cream method. My son only uses it for trimming his beard. It doesn't charge for very long. The head pivots. Micro Touch Reviews Analysis ; Micro Touch Triple-Blade Razor with 6 Refill Cartridges · 4, Ratings ; Micro Touch MAX Hair Trimmer, Green · 1, Micro Touch Solo Titanium is the all in one shaving accessory you will ever need. Trim; to a perfect stubble. Edge; great for beards, sideburns. What a waste of money. Dull blade and it was ridiculous. If you read reviews, do not waste your money, unless you have little to no hair to cut. Yes, my hair is. Micro Touch Max Titanium is the all in one personal trimmer that allows you to trim hair anywhere with micro precision. Ratings and Reviews. We'd love to hear. Unlike other reviewers, I actually bought, received, and used this product before posting a review. It works very well and the assortment of guards is excellent. It gets close as a blade, yet is safe to the touch. MicroTouch Max is the ideal solution for removing unwanted ear and nosehair, and makes trimming mustaches. Trims hair anywhere with micro-precision. Made from German Stainless Steel. Professional Grade personal hair trimmer. Trims the Reviews. Community Q & A.

Micro Touch Solo Titanium is the all in one shaving accessory you will ever need. Trim; to a perfect stubble. Edge; great for beards, sideburns, goatees and. Micro Touch Titanium Max trims hair anywhere with Micro Precision. This professional grade unit features: LED Light, German Stainless steel blades. The product is well made and requires no training to use, once customers get used to it. The reviewer mentions that it is easy to maintain their hair after the. Natural comb & cut blade angle · Micro-polished, titanium-bonded stainless steel blades · 5 custom attachments for the perfect length · Extendable handle for hard-. Good product, great value! · Great grooming · Very good · Titanium Max · Excellent product · Quick and easy to use · Micro touch trimmer · Close cut. MicroTouch Titanium Trim is the haircut and body groomer you've seen advertised on TV! Product Q & A. 1 out of 5 stars. Read reviews for Micro. Hair cuts made easy with the Micro Touch Trim Titanium. The at home hair & body groomer. Cut & trim, groom, edge with 5 trimming guides included. Micro touch titanium trim. Posted by Duffy Hamlett on Oct 25th One comment on this. It works great. Glad I purchased it. Worth the money. Hair cuts made easy with the Micro Touch Trim Titanium The at home hair & body groomer Cut & trim, groom, edge with 5 trimming guides included. This product is very helpful for me for grooming a nd great trimming for me, especially for reach to hard places as well. Would use this item product more. Hair cuts made easy with the Micro Touch Trim Titanium The at home hair & body groomer Cut & trim, groom, edge with 5 trimming guides included. I just bought it got home put it together and I had to try it right away. I like the safety cover that goes over the cutter for trimming sensitive areas. Designed to look and feel like a hair comb, titanium trim easily gives you a trim in the comfort of your own home. Micro Touch trim includes five attachments: 4. The all new Micro Touch Titanium Trim makes at home haircuts and body grooming easy. The 5 trimming guides, built-in light and extendable handle help cut, trim. My husband tried it this morning and found it quite useful for trimming sideburn area and hair at back of neck. It will be great for the times he grows a goatee. Its sharp blades ensure a clean and precise trim, while also prioritizing safety. With two attachments included, this trimmer offers versatility and convenience. Micro Touch Titanium Trimmer - 1 ct. out of 5 stars, average rating value. Read a Review. Same page link. (1) SKU $ Natural comb & cut blade angle · Micro-polished, titanium-bonded stainless steel blades · 5 custom attachments for the perfect length · Extendable handle for hard-. The all new MicroTouch® Titanium® Max, micro-precision trimmer has an ultra-thin head with a perfectly-angled, side-mounted blades, that goes beyond where.

Refi Car With Bad Credit

Can I Refinance my Auto Loan with Poor Credit? Don't assume that a bad credit score or lack of credit history will disqualify you from refinancing your auto. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. Go to any bank or credit union (credit unions generally have lower rates — you may just have to open an account there and keep some minimal. A Greater Nevada Credit Union car loan for bad credit can be the first Are there credit unions that refinance auto loans with bad credit? plus sign. Mass Bay Credit Union wants to help you lower your car payment by refinancing your new or used auto loan. Explore our great, low car and truck loan rates and. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. Having good credit will help you qualify for a better rate on your refinance. If you had bad credit when you originally applied for the loan but your credit has. There is no minimum credit score required to refinance a car loan, but you can unlock better terms with a higher score. iLending makes refinancing easy. Refinancing an auto loan can affect your credit score, since you'll need to submit to a hard credit pull when you apply for a loan. This can cause your score to. Can I Refinance my Auto Loan with Poor Credit? Don't assume that a bad credit score or lack of credit history will disqualify you from refinancing your auto. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. Go to any bank or credit union (credit unions generally have lower rates — you may just have to open an account there and keep some minimal. A Greater Nevada Credit Union car loan for bad credit can be the first Are there credit unions that refinance auto loans with bad credit? plus sign. Mass Bay Credit Union wants to help you lower your car payment by refinancing your new or used auto loan. Explore our great, low car and truck loan rates and. The approval process for a refinance can take as little as a few minutes. After your new loan is signed, you can have up to 60 days with no payments before. Having good credit will help you qualify for a better rate on your refinance. If you had bad credit when you originally applied for the loan but your credit has. There is no minimum credit score required to refinance a car loan, but you can unlock better terms with a higher score. iLending makes refinancing easy. Refinancing an auto loan can affect your credit score, since you'll need to submit to a hard credit pull when you apply for a loan. This can cause your score to.

We usually recommend waiting till the halfway point of your current car finance agreement before you refinance your car. Alternatively, you could put yourself. When financing a car with bad credit, a down payment, trading in your current vehicle, or both, can be particularly helpful. Each may lower the principal loan. You're probably not going to get a better rate any time soon. Bring it up to at least over and then try to refinance. What does it mean to refinance a car? Refinancing your car means replacing your current auto loan with a new one. The new loan pays off your original loan. Getting an auto refinance is still possible with a bad or low credit score, but you may not be offered the best interest rates. Knowing what lenders are looking. Refinancing a car loan is essentially just opening a new loan to pay off the existing car loan. This can be done to move a car loan over to Sharonview from. If you decide to refinance, you may be able to lower your monthly payment or reduce your APR. If you choose a loan term that is longer than the term remaining. When you need help refinancing a poor credit auto loan it's good to use refinancing companies like AutoNet Financial. We specialize in refinancing loans for. The bottom line? You don't need perfect credit to qualify for auto loan refinancing. Most credit types are accepted by lenders. What. Poor credit accepted. Even if you have bad or poor credit, you can apply. Borrowers with a credit score as low as are considered for OpenRoad Lending Auto. Best Bad Credit Auto Refinance Loans in · Auto Credit Express has long been one of our favorite auto lending networks for bad credit because it partners. What to Do to Refinance a Car Loan With Bad Credit · Provide basic information. To get started, all you need to do is provide some basic information, including. When you refinance a car loan, you replace your current auto loan with one that lowers your interest rate, reduces your monthly payment or cuts the total amount. You could have enough extra money to pay off your vehicle in a shorter amount of time and boost its value by visiting a mechanic. Call us Refinancing your car or truck means taking out a new loan to pay off your current vehicle loan. This could give you the opportunity to benefit from new terms. Advertised as low as APR (Annual Percentage Rate) assumes excellent borrower credit history. If you're asking yourself, "Should I refinance my car loan? Rates as of Aug 25, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Borrow from the equity you've built in your vehicle - a great alternative to traditional title loans, personal loans, and credit cards. Speak with a. In short, you are not refinancing the vehicle itself, but the loan. There are a lot of terms surrounding the concept of refinancing your car, which can be. If you originally took out a bad credit car loan, you may still qualify for refinancing if your credit score has improved since it began. Another factor that.

T Rowe Price Crypto

See all T. Rowe Price Group, Inc ETFs for FREE along their price, AUM Crypto · Disruptive Technology · Energy Infrastructure · ETF Building Blocks · ETF. T. Rowe Price Mutual Funds https://troweprice Rowe Price Expands Crypto Division. Sep 12, • powered by CryptoPanic. T. Rowe Price has had an early and front‑row seat to the development of cryptocurrencies and the distributed ledgers that enable them. Get the latest T Rowe Price Floating Rate ETF (TFLR) real-time quote, historical performance, charts, and other financial information to help you make more. The T. Rowe Price Group stock price forecast for the next 30 days is a projection based on the positive/negative trends in the past 30 days. FUND. T. Rowe Price U.S. Equity Research Fund. %, %, %, % ; PRIMARY BENCHMARK. S&P Close. %, %, %, %. Our panel discusses interest rates, inflation, crypto trends, and asset allocation considerations in a complex environment. The current price of TROW is USD — it has increased by % in the past 24 hours. Watch T. Rowe Price Group, Inc. stock price performance more closely. CryptoRank provides crowdsourced and professionally curated research, price analysis, and crypto market-moving news to help market players make more informed. See all T. Rowe Price Group, Inc ETFs for FREE along their price, AUM Crypto · Disruptive Technology · Energy Infrastructure · ETF Building Blocks · ETF. T. Rowe Price Mutual Funds https://troweprice Rowe Price Expands Crypto Division. Sep 12, • powered by CryptoPanic. T. Rowe Price has had an early and front‑row seat to the development of cryptocurrencies and the distributed ledgers that enable them. Get the latest T Rowe Price Floating Rate ETF (TFLR) real-time quote, historical performance, charts, and other financial information to help you make more. The T. Rowe Price Group stock price forecast for the next 30 days is a projection based on the positive/negative trends in the past 30 days. FUND. T. Rowe Price U.S. Equity Research Fund. %, %, %, % ; PRIMARY BENCHMARK. S&P Close. %, %, %, %. Our panel discusses interest rates, inflation, crypto trends, and asset allocation considerations in a complex environment. The current price of TROW is USD — it has increased by % in the past 24 hours. Watch T. Rowe Price Group, Inc. stock price performance more closely. CryptoRank provides crowdsourced and professionally curated research, price analysis, and crypto market-moving news to help market players make more informed.

Bitcoin News – Articles from t rowe price tag. T. Rowe Price Group, Inc. engages in the provision of investment management services. The company was founded by Thomas Rowe Price Jr. in and is. View T Rowe Price Group, Inc TROW investment & stock information. Get the Crypto; Earnings. Earnings. Earnings · Earnings Calendar · Earnings Releases. T. Rowe Price Group Inc. is a financial services holding company. The Company, through its subsidiaries, provides investment advisory services to individual. T. Rowe Price portfolio managers currently do not hold any cryptocurrencies in their investment strategies because of their speculative nature. Entering the Race: Fidelity Joins the Crowded Field by Filing for a Bitcoin ETF. Implications for T. Rowe Price and Beyond. Employee benefits are a vital. T. Rowe Price Group News · Download App · Get the latest cryptocurrency news directly in your inbox. · The CoinCodex. Cryptocurrency Price Tracker. T. Rowe Price and our associates do not recommend or offer investment opportunities in any financial instrument (e.g., stocks, funds, cryptocurrency, etc.) via. T. Rowe Price Group, Inc. (2bets.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock T. Rowe Price Group. Find the latest T. Rowe Price Group, Inc. (TROW) stock quote, history, news and other vital information to help you with your stock trading and investing. What Is the T. Rowe Price Group Inc Stock Price Today? The T. Rowe Price Group Inc stock price today is What Is the Stock Symbol for T. Rowe Price Group. Bloomberg Invest: Bitcoin, Blockchain and Broader Crypto. Wider PM EDT - Dinner & Discussion. Blue Macellari, Head of Digital Strategy, 2bets.ru Price. T Rowe Price Group Inc · January 22 Moral Money · December 29 News in-depth · November 2 Fund management · October 27 Asset manager T Rowe. Get the latest T Rowe Price Group Inc (TROW) real-time quote, historical performance, charts, and other financial information to help you make more informed. Latest News ; ETF Investing Tools. Cryptocurrency. Institutional Investors Eye $10T Digital Asset Boom. DJ Shaw ; 2bets.ru Daily ETF Flows. QQQ Has $T in. Blue Macellari, Head of Digital Strategy at 2bets.ru Price to talk through her experience across both traditional buy side, and native crypto desks. T Rowe Price Group (TROW) ; Previous Close ; Volume , ; Avg Vol 1,, ; Stochastic %K · % ; Weighted Alpha T. Rowe Price Active ETFs seek to outperform benchmark indexes through the added value of our investment management expertise and global research capabilities. Better investment T. Rowe Price vs. Crypto Stocks.

Closing Cost Fee Breakdown

Closing costs can run from 1% to 4% of your home purchase price — and they're are on top of your down payment. Calculate yours to avoid 'mortgage-close shock'. For buyers, closing costs often range between 2% and 6% of the purchase price. Seller closing costs most often start at 5% to 6%. Closing costs average between 2% - 6% of the loan amount. Mortgage closing costs include fees, points and other charges to buy, refinance or sell a home. The average closing costs can vary depending on the location and value of the property. Detailed Breakdown of Costs. Loan Estimate and Lender Fees. Upon. Get a Loan Estimate · Application fee (covers the cost of processing your application). · Appraisal (a determination of the value of your home). · Attorney fee . Mortgage Closing costs and fees explained · A fee for obtaining a credit report · A Loan origination fee – the amount the lender charges for processing loan. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. It's relatively simple to calculate closing costs. You just add up all the fees you're expected to pay on the day you close on your home. That can be a. Closing costs can run from 1% to 4% of your home purchase price — and they're are on top of your down payment. Calculate yours to avoid 'mortgage-close shock'. For buyers, closing costs often range between 2% and 6% of the purchase price. Seller closing costs most often start at 5% to 6%. Closing costs average between 2% - 6% of the loan amount. Mortgage closing costs include fees, points and other charges to buy, refinance or sell a home. The average closing costs can vary depending on the location and value of the property. Detailed Breakdown of Costs. Loan Estimate and Lender Fees. Upon. Get a Loan Estimate · Application fee (covers the cost of processing your application). · Appraisal (a determination of the value of your home). · Attorney fee . Mortgage Closing costs and fees explained · A fee for obtaining a credit report · A Loan origination fee – the amount the lender charges for processing loan. The average cost of closing fees for homebuyers is $6, The higher the purchase price of your home, the higher your closing costs will be. While the average. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. It's relatively simple to calculate closing costs. You just add up all the fees you're expected to pay on the day you close on your home. That can be a.

Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. Closing costs are things that have to be paid in order to close on your home, like property taxes, homeowners insurance, title search fees, appraisal fees, etc. The average closing costs can vary depending on the location and value of the property. Detailed Breakdown of Costs. Loan Estimate and Lender Fees. Upon. Do closing costs include a down payment? No, your closings costs won't include a down payment. But some lenders will combine all of the funds required at. Use this closing costs calculator to estimate your total closing expenses on your home mortgage, including prepaid items, third-party fees and escrow. In California, that may involve your lender's origination fee to set up your home loan to buying earthquake insurance and home insurance before moving in, and. For buyers, closing costs often range between 2% and 6% of the purchase price. Seller closing costs most often start at 5% to 6%. These fees typically represent a significant amount of the total home purchase and usually cost between three to six percent of the mortgage. Closing costs can. “Closing Costs” are the various fees associated with closing on a real estate transaction, such as title policies, inspection fees, mortgage origination fees. Standard buyer closing costs can generally be divided into two categories: lender fees and homeowner costs. Example of Closing Costs Breakdown · Land Transfer Tax $6, · Legal Fees $ + HST (Shaikh Law Real Estate Lawyer Fees) · Title Insurance (Estimated) $ Closing costs are described as all fees to buy a property and move in. The purchase price of your real estate transaction is excluded from closing costs. Some. Down payment: $15, (5%) Property taxes ($/month): $4, HOI ($/month): $1, Lender fees: $1, Attorney fees, town/state fees. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees. Estimate your total closing expenses for purchasing a. Closing costs for buyers typically run between 2% and 5% of the total home purchase price. · One-time closing costs include origination, appraisal, notary, and. Examples of closing costs include fees related to the origination and underwriting of a mortgage, real estate commissions, taxes, insurance, and record filing. Closing costs are the expenses and fees associated with the purchase and sale of a home, such as taxes, title insurance, appraisal, and lender fees. To cover their expenses in processing loan applications, mortgage lenders often charge an application fee and loan origination fee. Some origination fees are a. Closing costs are the fees and expenses you pay when you close on your home. They include standard expenses such as appraisal fees, title fees and the first. There are three types of closing costs that will show up on your Loan Estimate: Origination Charges, Services You Cannot Shop For, and Services You Can Shop.

5000 Amp

Euphoria Xpert EX5K Watt Mono Amp. Regular price $1, Buy in monthly payments with Affirm on orders over $ Learn more. The kw competition series amplifier is a watt mono block. It is capable of running up to 18 volts for up to watts. It is a linkable amp and. The VULCAN Series amps are Stetsom's latest models, with cutting edge technology and optimized design. They are excellent with bass as well as with voice. Goodall JP - 5, Amp, 66, joules 5S, 12V Lithium Ion Jumpstart Pack Delivering maximum START-ABILITY with more battery capacity and initial. It has a maximum power of Watts in 1 channel of 1 ohm, It features customized adjustments according to the trunk size and the most prominent frequency of. Buffered Pre-amp input; Selectable 6dBdB Boost @ 45Hz; DRIVESINK Heat 1 x Watts @ 1Ω. 1 x Watts @ 2Ω. 1 x Watts @ 4Ω. Parameters. A high-caliber 5-channel amplifier known for its 5 x watts into 8 ohms or 5 x watts into 4 ohms, all channels driven. Word around town is it's perfect. SIAD Full-Range Mono Amplifier · 5, x 1 @ 1 ohm RMS · 4, x 1 @ 2 ohms RMS · 3, x 1 @ 4 ohms RMS · Variable 12dB low pass filter: 40HzkHz · Variable. Delivering tremendous power at 1, 2, or 4 ohms, the Sundown SIA amps are built with power and stability at their core. Euphoria Xpert EX5K Watt Mono Amp. Regular price $1, Buy in monthly payments with Affirm on orders over $ Learn more. The kw competition series amplifier is a watt mono block. It is capable of running up to 18 volts for up to watts. It is a linkable amp and. The VULCAN Series amps are Stetsom's latest models, with cutting edge technology and optimized design. They are excellent with bass as well as with voice. Goodall JP - 5, Amp, 66, joules 5S, 12V Lithium Ion Jumpstart Pack Delivering maximum START-ABILITY with more battery capacity and initial. It has a maximum power of Watts in 1 channel of 1 ohm, It features customized adjustments according to the trunk size and the most prominent frequency of. Buffered Pre-amp input; Selectable 6dBdB Boost @ 45Hz; DRIVESINK Heat 1 x Watts @ 1Ω. 1 x Watts @ 2Ω. 1 x Watts @ 4Ω. Parameters. A high-caliber 5-channel amplifier known for its 5 x watts into 8 ohms or 5 x watts into 4 ohms, all channels driven. Word around town is it's perfect. SIAD Full-Range Mono Amplifier · 5, x 1 @ 1 ohm RMS · 4, x 1 @ 2 ohms RMS · 3, x 1 @ 4 ohms RMS · Variable 12dB low pass filter: 40HzkHz · Variable. Delivering tremendous power at 1, 2, or 4 ohms, the Sundown SIA amps are built with power and stability at their core.

Ferraz Shawmut, Mersen, AKR Series, Class L fuse, low voltage, V, " diameter, A, kA@V, replaces General Electric GF8B Direct from Peavey! Get Your IPR2™ Lightweight Power Amp Now with Free Shipping! Financing available. JP Goodall 12 Volt lithium Cobalt Amp Start•All Jump Pack. The Accuphase E Integrated Amplifier stands as a pinnacle of audio engineering, crafted to commemorate Accuphase's year anniversary. you need at least an alt upgrade and extra batteries if you want to consistently run at this power level. most 5k amps have dual inputs and. Taramps Bass 5k 1 Ohm Monoblock Amplifier Watts Rms 1 Channel Powerful Full Range Great for Sub/Bass RCA Input Subsonic Filter, Car Audio Class D. Buy Rose Technics RT/ RT Dual High-End ESPro Integrated DAC & Headphone AMP with Free shipping on HiFiGo, you can enjoy a year warranty and the. The RAS seamlessly integrates HDMI ARC (Audio Return Channel) for playback of video sound, and effortlessly streams from online sources to play your. HA Bass Amplifier. Designed with more control in mind. Virtually Built rugged, each amp is known for the clean, high-impact sound that put. Square D Power Zone 4 Switchgear lineup main-tie-main lineup; amp, three phase, three wire, volt AC. NW50H3 main & tie breakers (P trip unit). Power Acoustik RZRD Amplifier, Razor Series Subwoofer 1-Channel Amplifier, 2 Ohm Stable 2, Watt Max (New). out of 5 Stars. reviews. The TPTEQ offer 1 channel with advanced individual equalization features for Mid Bass and Mid High, plus the traditional Level, High and Low Pass Filter. Amp Heavy Duty solutions from Darrah Electric are competitively priced. Need a custom Amp Heavy Duty solution? Contact us today to learn more. The IPR boasts 2, watts per channel at 2 ohms and is under 7lbs. Featuring 2 channel independent fourth order Linkwitz-Riley crossovers, a variable-. SFBD DIGITAL MONOBLOCK FEATURES. • Digital Class-D Mono Block Amplifier. • Dual MOS-FET PWM Power Supply. • 1 Ohm Stable Load. RAS · 2 x Watts of robust. Class AB power, 4 Ohms · Class AB amplifier design · ESS premium bit. Digital to Analog Converter · Wireless aptX™ HD and AAC. Amp Rapid 6 Volt Rectifier R $15, Pulsed Power. Tested. 1 in Amp Rapid 6 Volt Rectifier R Weight, lbs. inventory. R Description. Amp-Clamp. Used with DSS Additional information. Weight, 1 lbs. Dimensions, 12 × 5 × 4 in. Related products Midtronics DSS Wall. The M embodies this spirit with time-honored craftsmanship and market-leading innovation and serves as the epitome of high-fidelity audio reproduction. RE AUDIO ZTX ZTX Series Digital Amp (W, Monoblock, Class D) for Vehicles is an efficient audio amplifier that delivers quality sound for an.

Steps To Open A Savings Account

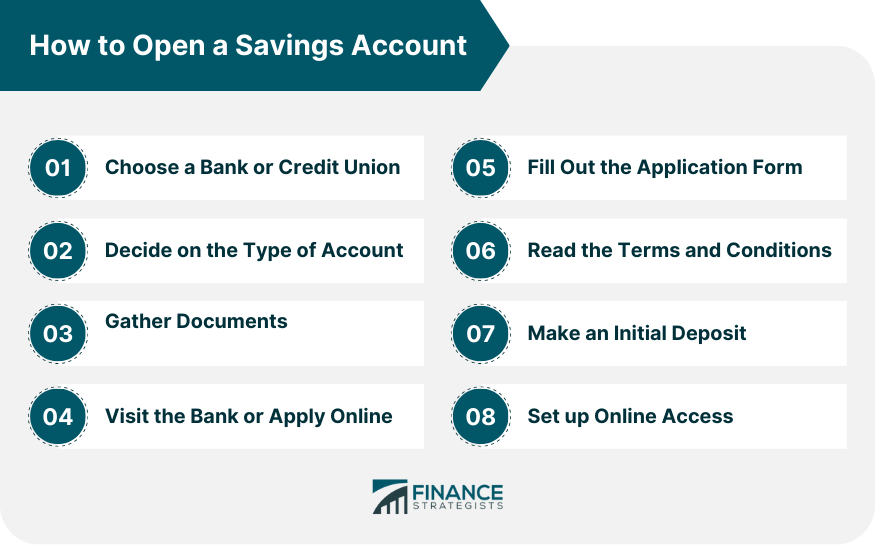

How do I transfer money between my savings account and chequing account? To apply online, just select the appropriate link from the top of this page and find the account you wish to open. You will then see instructions about applying. Steps to opening a savings account · 1. Choose your bank · 2. Pick a savings account type · 3. Understand terms and conditions · 4. Get your documents in order. Read further to understand how to open a savings account online and offline, along with the required documentation and eligibility criteria. How do I open a savings account? To open a High Yield Savings Account, click the ”Open an Account” button on the Home or HYSA pages. To open a Certificate of. Opening a bank account is as simple as gathering the necessary documents and information and applying online or in person. To open a regular Savings Account online, you will need documents such as your ID proof, address proof, PAN card, Aadhaar card, bank account statement of at. If you're under 18, you might need to go in person with your parent or legal guardian How can you start saving money? Starting to save money can be a very. To open a savings account, you will need to provide personal information, such as a government-issued ID, contact information, and your Social Security number. How do I transfer money between my savings account and chequing account? To apply online, just select the appropriate link from the top of this page and find the account you wish to open. You will then see instructions about applying. Steps to opening a savings account · 1. Choose your bank · 2. Pick a savings account type · 3. Understand terms and conditions · 4. Get your documents in order. Read further to understand how to open a savings account online and offline, along with the required documentation and eligibility criteria. How do I open a savings account? To open a High Yield Savings Account, click the ”Open an Account” button on the Home or HYSA pages. To open a Certificate of. Opening a bank account is as simple as gathering the necessary documents and information and applying online or in person. To open a regular Savings Account online, you will need documents such as your ID proof, address proof, PAN card, Aadhaar card, bank account statement of at. If you're under 18, you might need to go in person with your parent or legal guardian How can you start saving money? Starting to save money can be a very. To open a savings account, you will need to provide personal information, such as a government-issued ID, contact information, and your Social Security number.

How do I transfer money between my savings account and chequing account? How to Open an eSavings Account · Sign into Online Banking. · On the Accounts Summary page, find the “Apply Now” box at the top right-hand side, and click on. Your Social Security number. · A valid, government-issued photo ID like a driver's license, passport or state or military ID. · A minimum opening deposit of $ Different financial institutions have different processes but, typically, you'll request to open a primary savings account either online, in a branch or over. Simply select an account, enter your personal information, verify your information and choose features & funding options. You will receive an email once your. It takes just 3 steps to open a TreasuryDirect Account. Step 1. Choose the instructions on how to buy electronic gift savings bonds in TreasuryDirect. Just start small and keep it simple. These five tips will help you reach those bigger goals, one step at a time. It should only take a few minutes to open a savings account. And, whether you're opening it online or in person, the process is pretty simple. between $25 and $ to open a savings or checking account. Tip. Find out how much you must keep in the account at all times to avoid or reduce fees. This is. There are different types of accounts, each with its own rules, purposes, and interest rates. Here's a breakdown of various bank accounts and how they can help. Simply choose the account that's right for you and apply online, book an appointment in person, or over the phone. How do I choose a. Visit a bank branch or fill out an application form online. Submit the required KYC proof documents. Receive your account details. Use your savings account. A Savings Account is a safe place to keep your money & make it grow. ICICI Bank lets you open a Bank Account Instantly. Apply now for a hassle-free. Here is a quick guide on how to open a Savings Account online in Union Bank of India: · Aadhaar card · Mobile linked to Aadhaar for OTP · PAN card · Recent scanned. How to Open a High-Yield Savings Account · 1. Shop for the Top Rates · 2. Choose the Institution Best for You · 3. Complete the Account Application · 4. Fund. Here is a quick guide on how to open a Savings Account online in Union Bank of India: · Aadhaar card · Mobile linked to Aadhaar for OTP · PAN card · Recent scanned. How to Open a Savings Account? · 1. Compare banks · 2. Check eligibility (of credit unions) · 3. Gather all personal documents · 4. Open and fund the account. How will you make the first initial deposit? Most banks allow you to open a checking or a savings account with cash, a check from another institution, or a. A Savings Account is a secure way to grow your money. Open a savings bank account instantly with IDFC FIRST Bank for a smooth, hassle-free experience. Open a Savings Account online with HDFC Bank through your mobile phone or laptop through InstaAccount. You can initiate the process with just your mobile number.

What Bank Has The Best Savings Interest

:max_bytes(150000):strip_icc()/BestHigh-YieldSavingAccounts-cf61d112a9254710acfed7122a31a417.jpg)

With a % rate, First Community Bank offers the highest APY high-yield savings account. To save you time from having to review bank and credit union. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Best for no minimum deposit With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. The Western Alliance Bank High-Yield Savings Premier account offers % APY on the entire account balance. It has no account activity or maintenance fees. With a % rate, First Community Bank offers the highest APY high-yield savings account. To save you time from having to review bank and credit union. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Best for no minimum deposit With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance. High-Interest Savings Accounts from Discover Bank, Member FDIC offer high yield interest rates with no monthly balance requirements or monthly fees. Star Savings Account. Balance Tier All Balances. Interest Rate %. Annual Percentage Yield (APY) %. Available in all states. For example, Bank of America, Chase Bank, and Wells Fargo offer a measly APY of % on their savings accounts, whereas most of the options listed above are. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. The Western Alliance Bank High-Yield Savings Premier account offers % APY on the entire account balance. It has no account activity or maintenance fees.

Start saving with a Varo Bank Savings Account and qualify for up to % APY on up to $5k. With Varo Bank, you get everything you need to reach your savings. EQ Bank has remained at the top of our list for a while with its 4% rate. The only ones to supplant EQ Bank is none other than EQ Bank. It's simple. You choose. Truist One Checking has all the benefits you care about—no overdraft fees, coverage when you accidentally overspend, and a credit card loyalty bonus. The best. Capital One used to have an APY that lagged the rest of the market, making it a substandard choice. Now it has an APY that's just as good as most banks. It's. Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - Performance Savings · SoFi Checking and Savings. A high yield savings account to help reach financial goals with a % Annual Percentage Yield & no minimum balance or service fees. Apply online today! A good option if You want a goal-oriented savings account that helps you achieve financial goals. ; Interest rates. Earns at a steady rate of%. ; Automatic. Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of America. Yield (APY) in effect on the maturity date for CDs not subject to a Special Interest Rate, unless the Bank has notified you otherwise. The Bank may limit. Why a high-yield savings account is always a good idea · Best overall: LendingClub High-Yield Savings · Best for earning high APY: UFB Preferred Savings . Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. having bucks in my checking account. I'm so frustrated that I Works with 40+ banks and credit unions to find highest % APY. You will receive an email once your application is received and a follow-up email telling you whether it has been approved, plus any next steps. Open. My building society or bank has a better rate than accounts here. Why isn't it featured? Best Savings Accounts – September · Top Savings Account Interest Rates · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One - There are also many types of savings accounts to meet your needs, each with a high APY: American Express (% APY), UFB Direct (% APY), CIT Bank (%. Raisin's single, unified account dashboard shows you all your deposit products and their balances in one place. Which bank has the best savings account? When. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. APY comparison ; Marcus by Goldman Sachs, %, $0 ; Capital One, %, $0 ; Discover Bank, %, $0 ; Ally Bank, %, $0. Please note that the Bank has reduced interest rates to 3% on savings accounts for balances up to Rs. 5 lac. The interest rate paid earlier was % for.

1 2 3 4 5